- You need technical analysis knowledge, forex trading strategies, an in-depth understanding of how your trading tools work, and good knowledge of backtesting methodologies to build a good Expert Advisor.

- The MQL4 and MQL5 are the two most popular programming languages for building Expert Advisors.

- You don’t have to build your Expert Advisor yourself. You can hire a professional for that. Just make sure it’s an EA programmer you’re hiring and not just any developer.

While foreign exchange trading inspires traders worldwide due to its quick money-making potential, people use different methodologies to trade the currency market. Expert Advisors (EA) are known to be one of the widely used tools for trading currency pairs with speed and accuracy.

This article discusses expert advisor programming in detail, including the fundamentals, basic terminologies, risk management, and the challenges EA programmers face in developing the trading robot. We’ll also highlight different ways to create your first EA, followed by a brief discussion on the future of EA programming.

What are the Basics of Expert Advisor (EA) Programming?

Since EA programming involves developing complex algorithms and a set of rules for the trading robot to follow, understanding the basics is crucial. It helps forex traders build customized EAs to maximize market opportunities, as well as enhance their trading exposure.

1. Fundamental Concepts

The key concepts of EA programming include trading parameters (entry and exit rules), risk management, the incorporation of technical indicators, and trade execution. It is worth mentioning here that you need a sound understanding of various forex trading strategies, market dynamics and backtesting methodologies to develop a worthwhile expert advisor.

It takes just more than programming skills to program an expert advisor. You need technical analysis knowledge, forex trading strategies, an in-depth understanding of how your trading tools work, and good knowledge of backtesting methodologies.

2. Basic Terminology

Familiarizing yourself with basic terminologies in expert advisor programming is crucial to helping you navigate the process effectively. Here are some key terms to know:

- Expert Advisor (EA): An automated trading robot developed using programming languages like MQL. It executes trades based on predefined rules and conditions.

- Indicators: Indicators refer to technical tools forex traders use to analyze market data and generate trading signals. Common indicators include Moving Averages, RSI, MACD, and Bollinger Bands.

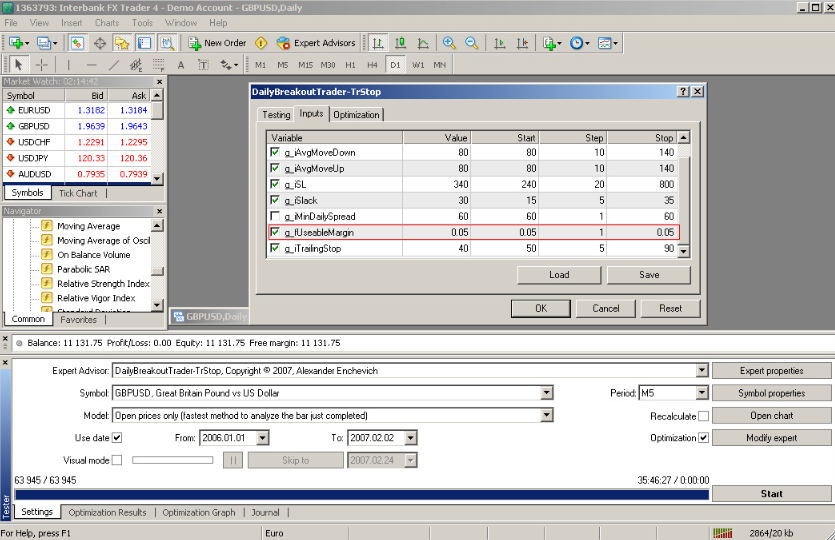

- Backtesting: Testing an EA’s performance using historical market data to assess its effectiveness. It helps identify potential flaws or areas for improvement in the forex trading strategy.

- Trade Execution: The process of placing orders in the market based on the trading strategy defined in the EA. It involves sending orders to the broker’s trading platform to open or close positions.

- Risk Management: Strategies and techniques used to manage and control the potential risks associated with trading, including setting stop-loss and take-profit levels and adjusting position sizes.

3. Principles and Best Practices of Expert Advisor Programming Services

Principles and best practices of Expert Advisor (EA) programming services refer to adhering to coding standards, implementing efficient and reliable trading algorithms, and considering risk management strategies. It is important to follow modular programming principles, use proper error-handling techniques, and thoroughly test EAs to ensure optimal performance and stability in live trading environments.

What are the Elements of EA Programming?

Elements of Expert Advisor Programming for MT4/MT5 involve understanding the syntax and structure of the MetaQuotes Language (MQL) used to write the code.

Forex traders need to familiarize themselves with variables, functions, operators, and control structures to build the logic of their trading strategies within the Expert Advisor. Additionally, incorporating technical indicators, candlestick patterns, and price action analysis techniques into the code can enhance the Expert Advisor’s decision-making process.

Another crucial element is risk management, where forex traders can define parameters such as stop-loss, take-profit levels, and trailing stops within the Expert Advisor code. Implementing proper error-handling techniques, backtesting the strategy on historical data, and optimizing the parameters can help ensure the robustness and efficiency of the Expert Advisor.

Furthermore, integrating external libraries, custom indicators, and advanced trading techniques like hedging or martingale strategies can add flexibility and sophistication to the Expert Advisor programming.

Understanding EA’s MQL4 and MQL5 Programming Languages

MQL4 and MQL5 are programming languages specifically designed to create automated trading systems and custom indicators within the MetaTrader platform. These languages are used in the field of algorithmic trading, allowing traders to develop their own trading strategies and indicators.

MQL4

MQL4 is the older version and was initially introduced with MetaTrader 4 (MT4) powered by Metaquotes Software Corp. It uses a syntax similar to the C programming language, making it relatively easy for programmers familiar with C, C++, or Java to learn and use MQL4.

It provides a wide range of built-in functions and libraries, allowing developers to access market data, execute trades, and perform various calculations. MQL4 supports both script-based programming and the creation of Expert Advisors (EAs) – automated trading systems.

MQL5

On the other hand, MQL5 was introduced with MetaTrader 5 (MT5) and offers enhanced features and capabilities compared to MQL4. It supports object-oriented programming (OOP), making source code organization and reuse more convenient.

MQL5 introduces additional data types, new functions, and a more flexible event-driven programming model. It also allows for multi-threading, which enables the execution of multiple tasks concurrently. However, it is important to note that MQL5 is backward-incompatible with MQL4, meaning that code written in MQL4 needs to be modified to work with MQL5.

The Role of Algorithms in EA Programming

Algorithms play a critical role in leveraging expert advisor programming services by providing the logic and instructions for automated decision-making. They enable efficient analysis, optimization, risk assessment, and system integration. Trading robots also help drive consistency, scalability, and agility.

Analysis and Prediction Tools in EA Programming

Analysis and prediction tools in EA programming services provide valuable insights and foresight by leveraging data analytics and machine learning techniques to identify patterns and anticipate future trends.

Risk Management Features and Tools

Risk management is crucial for trading strategies, and Expert Advisors (EAs) incorporate various tools to achieve this. For instance, stop-loss orders help limit potential losses by automatically closing positions at predetermined price levels, while take-profit orders secure profits by closing positions at target prices. Similarly, position sizing ensures the appropriate capital allocation for each trade, considering factors like account balance and risk appetite.

Some Expert Advisors also analyze risk-reward ratios to assess trade profitability. These risk management features protect capital, prevent significant losses, and improve overall trading performance.

What are the Two Options to Build Your First Expert Advisor (EA)?

There are two primary ways to build your first Expert Advisor (EA) in MQL4 or MQL5 programming languages:

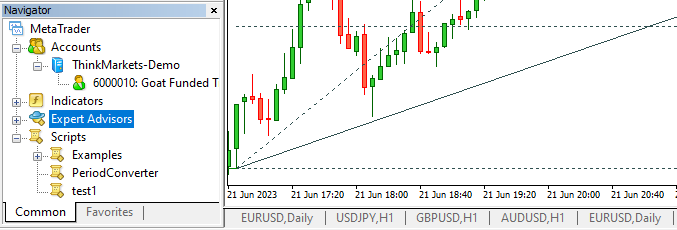

Option 1: Develop an EA by yourself

This approach involves writing the code for your Forex EA from scratch using the MQL4 or MQL5 language yourself. You can utilize the MetaEditor tool within the MetaTrader platform to create a new EA project, define the trading logic, implement risk management rules, and handle trade execution.

Manual coding gives you complete control over the functionality and customization of your trading robot, but it requires you to have sufficient programming skills and knowledge of the MQL language.

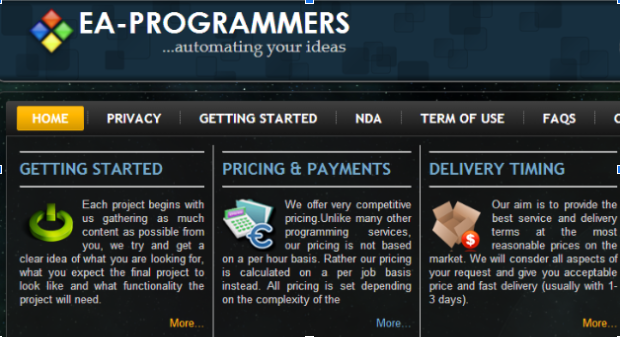

Option 2: Hire professional EA programmers

You can also hire the services of professional EA programmers if you lack programming skills and experience or prefer a more visual approach. Hiring the programming services of a professional ensures the development of a reliable and efficient trading system.

Their expertise in coding and trading algorithms allows them to create customized Expert Advisors tailored to specific trading strategies. This minimizes errors, enhances performance, and maximizes the potential for successful automated trading.

BONUS: Free EA Programming Tutorials

Today, there are numerous resources available to help you learn EA programming skills for free. Let’s have a quick look at a few of them below.

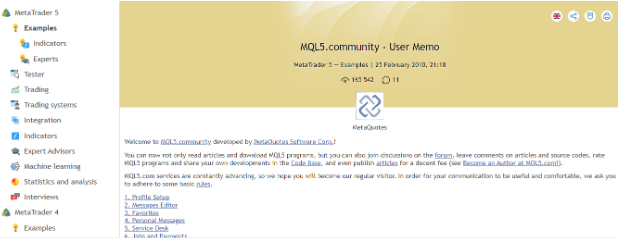

- MQL4.com: The official MQL4 website offers a wide range of free tutorials, articles, and documentation on expert advisor programming in MQL4. It covers various topics, from basic concepts to advanced techniques, providing step-by-step guidance for building EAs.

- MQL5.com: Similarly, the official MQL5 website provides comprehensive tutorials and resources for EA programming in MQL5. It covers topics such as EA development, indicators, libraries, and optimization techniques, offering detailed explanations and examples.

- YouTube: YouTube hosts numerous free video tutorials on EA programming in MQL4 and MQL5. Many channels provide step-by-step instructions, coding tips, and strategies for creating EAs. Examples of channels to explore include “MQL4 Tutorial” and “MQL5 Tutorial.”

- Forex Trading Forums: Online forex trading forums like Forex Factory and ForexpeaceArmy also have dedicated sections for MQL4 and MQL5 programming discussions and tutorials. These communities actively share knowledge, coding techniques, and resources for learning expert advisor programming skills.

- Algorithmic Trading Courses: If you would like a more structured approach to learning how to program your expert advisors, algorithmic trading courses are the way to go.

How Do You Overcome Some of the Common Challenges in EA Programming?

Since we’ve discussed quite a lot about EA programming so far, let’s quickly examine its challenges and ways to overcome them.

1. Complexity

EA programming services involve dealing with complex trading algorithms, integrating market data, and handling various events and conditions. It is important to break down the problem into smaller, manageable tasks to overcome this challenge. Plan your EA design and logic carefully, use modular programming techniques, and document your code for better readability and maintainability.

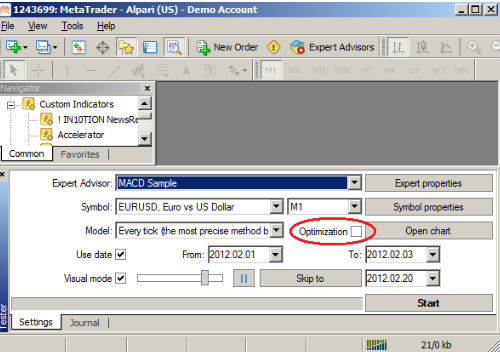

2. Testing and Optimization

Testing and optimizing an expert advisor can be time-consuming and challenging for EA programmers. It is crucial to thoroughly test your EA on historical data, different market conditions, and simulated trading environments before deploying it live.

3. Handling EA’s Limitations

To handle EA limitations, optimize code efficiency, monitor connectivity, and manage errors, set realistic expectations, adapt to market conditions, and refine the EA based on live trading feedback.

4. Addressing Changing Market Conditions

Being a rationale developer, you need to adapt to the changing market conditions by monitoring data, adjusting strategies, and implementing adaptability in the EA. You must stay informed, incorporate risk management, and regularly optimize based on real-time performance to ensure effectiveness in evolving markets.

What is the Future of EA Programming?

The future of expert ad programming holds significant potential as emerging technologies such as AI and ML continue to advance. These advancements will enable the development of more sophisticated algorithms and predictive analytics, allowing EAs to make intelligent trading decisions based on real-time data and market conditions.

Moreover, increasing cloud computing and IoT adoption is likely to revolutionize expert advisor programming by providing enhanced connectivity and scalability. As the digital landscape evolves, there will be a stronger emphasis on security and privacy. EA programming will need to incorporate robust security measures and adhere to privacy regulations to safeguard sensitive data and protect against cyber threats.

Emerging Trends in EA Programming

Here we list some emerging trends in EA programming;

- Integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies.

- Adoption of cloud computing.

- Increased focus on security and privacy measures.

- Utilization of data analytics and predictive modeling for decision-making.

- Incorporation of Internet of Things (IoT) and edge computing capabilities.

- Integration of blockchain technology for secure and transparent transactions.

- The growing importance of sustainability and green architecture practices.

How AI is Shaping the Future of EA Programming

AI is significantly shaping the future of EA programming by revolutionizing decision-making, automation, and analytics. With the power of machine learning algorithms, AI can analyze vast amounts of data, identify patterns, and generate valuable insights for optimizing architectural design and decision-making processes.

AI-driven Expert advisors can adapt and learn from changing market conditions, enabling more intelligent and proactive decision-making. Moreover, AI technologies like natural language processing and computer vision can enhance the understanding and utilization of unstructured data, enabling better integration and analysis of information.

Key Takeaways from EA Programming

- EA programming involves designing, organizing, and managing the technology.

- Algorithms play a crucial role in EA programming, providing the logic for automated decision-making.

- MQL4 and MQL5 are programming languages specifically designed for EA programming in MetaTrader.

- Challenges in EA programming include complexity, testing, and optimization.

- Addressing EA’s limitations requires code optimization, error handling, and realistic expectations.

- Risk management features and tools in EA programming help identify and mitigate risks.

- The future of EA programming involves advancements in AI, ML, and cloud computing, and a focus on security, privacy, and sustainability.

Summary

While expert advisors can be powerful tools for automating forex trading strategies, it’s crucial to remember that they are not a guaranteed path to riches. Responsible use, including thorough backtesting, risk management, and ongoing monitoring, is essential for maximizing the potential benefits and mitigating potential risks.