- EAs automate trading decisions and execution.

- EAs remove emotional biases from trading.

- Backtesting and optimization enhance EA performance.

- EAs enable diversification and fast trade execution.

- EAs incorporate risk management techniques.

- EAs provide continuous market monitoring.

- Developing EAs requires technical and trading expertise.

- Regular evaluation is crucial for EA performance.

Forex trading offers extensive profit-making opportunities but requires profound market knowledge and years of trading experience.

While this might not be possible for everyone, some alternative ways to trade the forex market also exist, such as copy trading or using automated trading systems like Expert Advisors (EA). This article discusses how to trade with Expert Advisors in detail.

- What Is Expert Advisor (EA) Trading?

- How Do You Trade with an Expert Advisor?

- BONUS: Why Do You Need a Virtual Private Server (VPS) for Trading with EAs?

- Is It Possible to Use More Than One Forex EA in Trading at Once?

- How Do I Make my Expert Advisor (EA) to Trade For Me?

- Can EA Trading Be Profitable?

- How to Stop an EA From Trading?

- Conclusion

What Is Expert Advisor (EA) Trading?

Expert Advisor (EA) trading refers to using software designed to automate the trading process. It includes everything from trading decisions to trade execution. While traders primarily use EAs to trade currency pairs, they can be employed to trade any financial instrument, including stocks, indices, commodities, and cryptocurrencies.

EAs, also known as forex robots, are developed using specified programming languages such as MQL4 and MQL5. These robots make decisions based on the results of their market analysis and the techniques they have been taught to use. This includes technical indications, price patterns, and risk management parameters. Once an EA is engaged, it automatically watches the market, looks for trading opportunities, and places trades without any intervention from a trader.

Using forex trading robots has several benefits, including the possibility for quick and efficient trade execution and the elimination of emotional and psychological biases that help traders make consistent profits. EAs can function around the clock, especially when hosted on forex VPSs, allowing traders to take advantage of market fluctuations outside traditional trading hours.

How Do You Trade with an Expert Advisor?

Trading forex with Expert Advisors (EAs) involves harnessing the power of automation to execute trades in the forex markets. It includes selecting a reputable broker that offers a compatible trading platform, such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5), to exploring a wide range of pre-built EAs or developing your own using programming languages like MQL4 or MQL5, followed by their installation, configuration, and trade placement.

Below, we’ll take you through the step-by-step guide to help you understand the process better.

Step 1: Choose a Reliable Broker

Selecting a broker is the first step towards EA trading. Essentially, having retail investor accounts with a broker is among the prerequisites of forex trading. While the market is full of legit and scam brokers, selecting a reputable and reliable broker is essential. Usually, regulated brokers are considered safer compared to non-regulated ones.

You can also check a broker’s rating with third-party reviewing websites like Trustpilot, BrokersView, etc. Reading clients’ feedback on social platforms, i.e., Reddit and Quora, may also help you assess whether or not the broker is worth signing up for trading CFDs and other tradable assets.

Also, ensure your selected broker offers compatible trading platforms widely used for EA trading, such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

Step 2: Develop a Trading Plan or a Trading Strategy

Before utilizing an EA, having a well-defined trading plan or strategy is crucial. Determine your trading goals, risk tolerance, and preferred trading approach. This includes selecting technical indicators, defining entry and exit criteria, and establishing risk management rules. A clear strategy will guide the development and configuration of your trading robot.

Here’s a list of the best algorithmic trading strategies you might find useful.

Step 3: Choose and Install an Expert Advisor

Select an EA that aligns with your trading strategy. You can either develop your own EA using programming languages like MQL4 or MQL5 or choose from a wide range of pre-built paid expert advisors available in the market. Once you have an EA, install it on your MT4/MT5 following the instructions, or seek advice from EA providers if necessary.

Step 4: Test the Expert Advisor

Before deploying your EA in live trading conditions, it is crucial to test it thoroughly using historical data. This process, known as backtesting, helps evaluate the EA’s performance under various market conditions. You can use reliable backtesting tools available within the Metatrader market to simulate trades and analyze the results. If necessary, adjust the EA’s settings or modify the strategy to improve its performance. Do not hesitate to repeatedly use the EA with a demo account to remove bugs and errors.

Step 5: Monitor the Expert Advisor

After configuring your EA, you need to monitor its performance regularly. Review its profitability and risk measures and monitor its trading activities to verify that it is following the specified plan. Based on the outcomes, you may need to change some parameters to optimize it.

Step 6: Manage Risk

When using an EA in trading, employ sound risk management strategies. Decide where to place stop-loss and take-profit orders to reduce risk and preserve gains. Depending on the size of your trading account and your comfort level with risk, you should alter the amount you risk with each transaction. Examine your trading goals and risk management settings frequently to ensure they are in sync with market trends.

Step 7: Continuous Learning

Using an EA for trading demands constant study and adjustment. Keep abreast of any developments in the market or trading circumstances that might affect the efficacy of your EA and act accordingly. Learn as much as possible about various trading patterns, indicators, and tactics to deepen your market expertise. Keep your trading plan and EA under constant scrutiny and improve it as market conditions change.

BONUS: Why Do You Need a Virtual Private Server (VPS) for Trading with EAs?

A Virtual Private Server (VPS) allows for consistent and hassle-free trading. Unlike your PC, a VPS is located in a secure data center with uninterrupted access to the internet and power supply and has zero downtime. Just think about what that does for your Expert Advisor. That means it is running around the clock without interruption.

Second, a VPS facilitates trade execution with minimal latency. High-frequency trading and trade execution based on time-sensitive market circumstances rely heavily on this low latency. Using a virtual private server (VPS) may significantly improve the speed and precision of your EA’s trade executions.

Another advantage of using a VPS is its manageability from afar. Remote desktop connections and other remote access protocols allow you to access it from any location. That’s how you can keep tabs on your trade and make any adjustments while away from your desktop computer. Undoubtedly, changing your EA’s parameters, reviewing trading activity, and doing routine system maintenance using a VPS feel like a breeze.

While VPS ensures uninterrupted trading operations, improves trade execution speed, and enhances the flexibility of your trading activities, not all VPS are worth your investment. Although multiple VPS providers exist, Forexvps.net is one of the best VPS providers available.

Is It Possible to Use More Than One Forex EA in Trading at Once?

Using multiple Forex Expert Advisors (EAs) simultaneously in trading is possible. Running multiple trading robots allows for the diversification of trading strategies, capturing a wider range of market opportunities and reducing reliance on a single trading approach. It can help distribute risk and enhance risk management by mitigating the impact of underperforming EAs.

However, it is important to manage the interaction between multiple EAs carefully, considering factors like trading styles, timeframes, and risk parameters. Proper configuration, position sizing, and ongoing performance monitoring are essential to ensure the coordinated operation and optimal results of the portfolio of EAs.

How Do I Make My Expert Advisor (EA) to Trade For Me?

To allow your Expert Advisor (EA) to trade on your behalf, follow these steps:

1. Prepare your Expert Advisor

Ensure you have the EA file (.ex4 or .ex5) ready. Open your MT4/MT5 trading platform and go to the “Navigator” panel. Right-click on “Expert Advisors” and select “Open Data Folder.” In the opened folder, locate the “MQL4” or “MQL5” folder and then the “Experts” folder. Here, you need to copy the EA files.

On the trading terminal, click the “AutoTrading” button. This button is typically located on the top toolbar. It allows the EA to execute trades based on its programmed rules when activated.

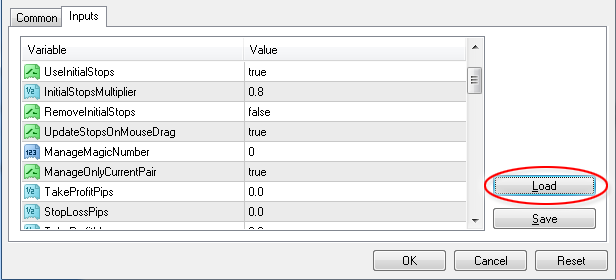

Drag and drop the EA from the “Navigator” panel onto the desired chart of the trading instrument you wish to trade. A window will appear with the EA’s settings and parameters. Adjust the settings as needed and click “OK” to attach the EA to the chart.

2. Monitor

Watch the Experts tab at the bottom of your trading platform. You should see its name listed if the EA runs without errors. Monitor the EA’s activity, including its open trades, modifications, and performance metrics.

3. Review Performance

You also need to review and adjust the risk management settings of the EA, such as lot size, stop-loss, take-profit levels, and any other parameters defined in the EA’s settings. Ensure they align with your risk tolerance and trading strategy.

4. Optimize

Regularly assess the market conditions and adapt the EA’s settings or consider optimizing its parameters if needed.

Can EA Trading Be Profitable?

Yes, EA trading can be profitable, but it depends on the effectiveness of the EA’s strategy, market conditions, risk management, and proper implementation.

How to Stop an EA From Trading?

To stop an EA from trading, you can disable the “AutoTrading” button in the trading platform or remove the EA from the chart where it is attached.

Conclusion

While Expert Advisors offer the allure of automated trading and potential benefits, remember that they are not a guaranteed way to profit from the market. Therefore, it is important to do your research, backtest your EA rigorously, and optimize it thoroughly before applying it to your live trading account.