The Secret Cost that’s Quietly Eating Away at Your Trading Profits

You’ve bought an Expert Advisor (EA), seen those tempting performance results, and you’re eager to replicate them. The backtests and showcase accounts paint a picture of soaring profits. The line chart climbs steadily from the bottom left to the top right, and you’re sold. You trust it.

But as you start trading live, something feels off. The results don’t match what you saw. What’s going on?

Here’s the hidden truth: latency is costing you money. And it’s not something most traders even realize until it’s too late.

In this article, we’re going to show you exactly how latency impacts your trading results, based on an eye-opening experiment we conducted at ForexVPS.net.

If you’ve ever been frustrated that your EA’s real-world performance doesn’t match the backtests or promises you relied on, this is for you.

Listen to our podcast discussing this experiment:

The Journey of a Forex Trader: From Promise to Frustration

Most traders follow a similar journey when they get started with an EA. You land on a website showcasing remarkable performance results—charts that climb upward, testimonials from happy traders, and promises of success. You invest in the software, eager to replicate those results, but the truth is, a lot is going on under the hood that you may not be aware of.

The reality is often far more complex. Latency, slippage, and execution times are just some of the variables that can stop you from achieving the same success you were promised. Your EA might be flawless in backtests, but in the real world, milliseconds matter.

The Latency Cost Experiment: A Tale of Two VPS Servers

At ForexVPS.net, we decided to run a technical case study to expose how much latency affects trading results. We called it the “Latency Cost Experiment”, and the results were mind-blowing.

Setting Up the Experiment:

To demonstrate the impact of latency, we set up an experiment using two different Virtual Private Servers (VPS)—one in London and one in New York City. Both VPS were provided by ForexVPS.net, and we used real trading accounts generously provided by one of our partnering brokers, Switch Markets.

How the Experiment Was Conducted:

- Locations: We set up two separate VPSs. One was in London, right next to our broker’s server. The other was in New York City, thousands of miles away.

- Broker and Accounts: We used Switch Markets as our broker and created real trading accounts for each VPS. Both accounts started with a balance of $10,000 and ran identical setups.

- The Trading Strategy: Each VPS used the same simple Expert Advisor (EA) to trade on the GBP/JPY currency pair. Every 30 seconds, a new trade was opened in the opposite direction while the previous trade was closed for a total of 120 trades. We used a lot size of 0.01 for each trade just to keep things simple.

- Why London and NYC?: The broker’s servers were located in London, which meant that the VPS closest to London would have minimal latency, while the NYC VPS would experience a delay.

Our goal was to meticulously record and measure the difference between the price seen on the chart when the EA triggered the trade and the actual price filled by the broker. This would let us calculate exactly how much latency was costing—or saving—on each server.

The Results: Numbers Speak Louder Than Words

We measured the latency for both setups (VPSs), and the results were exactly what you might expect:

- London VPS: Average latency to the broker’s server was <1 millisecond.

- New York City VPS: Average latency was about 75 milliseconds.

Now, here’s where things get interesting, as the trading results were really staggering. After placing 120 trades on each VPS, we calculated the cumulative slippage for both accounts:

- London VPS: The cumulative slippage was only +0.20 pips—almost negligible. Here, almost all trades were filled at the price seen on the chart, thanks to ultra-low latency.

- NYC VPS: We ended up with a cumulative slippage of -1.50 pips after 120 trades. This means that over the course of the experiment, many trades had a small, unfavorable difference in price—resulting in a loss. We lost 1.50 pips purely due to latency.

In simple terms, the New York VPS was consistently losing money simply because of the time it took for trades to reach the broker’s server—75 milliseconds of latency on average compared to under 1 millisecond in London.

Total Impact: There was a 1.70 (1.50 + 0.20) pips difference between the two accounts, favouring the London VPS. It might not sound like a lot, but let’s break down what that means in dollar terms.

Visualizing the Impact of Latency on Trading

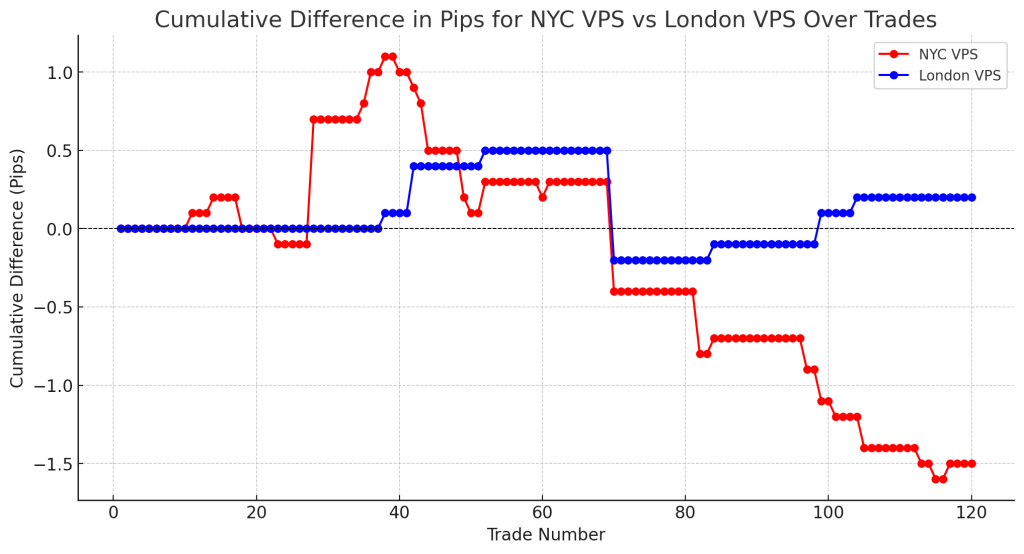

The Cumulative Slippage Comparison Chart above highlights the dramatic effect that latency had on the performance of the two VPS setups—London VPS and NYC VPS—across 120 trades. The blue line represents the cumulative slippage of the London VPS, and the red line represents the same for the NYC VPS.

The chart clearly shows the difference in cumulative slippage over time, with the London VPS ending at +0.2 pips, while the NYC VPS ended at -1.5 pips. This illustrates how even small differences in latency can compound into significant costs over the long term.

- Notice the steady increase in cumulative difference for the NYC VPS, reflecting latency-based losses that accumulated over time.

- In contrast, the London VPS maintained a steady, minimal cumulative slippage, even resulting in a small net gain of +0.2 pips.

This chart is the visual proof that latency can directly affect your trading outcomes, creating either incremental profits or avoidable losses—depending on how optimized your VPS setup is.

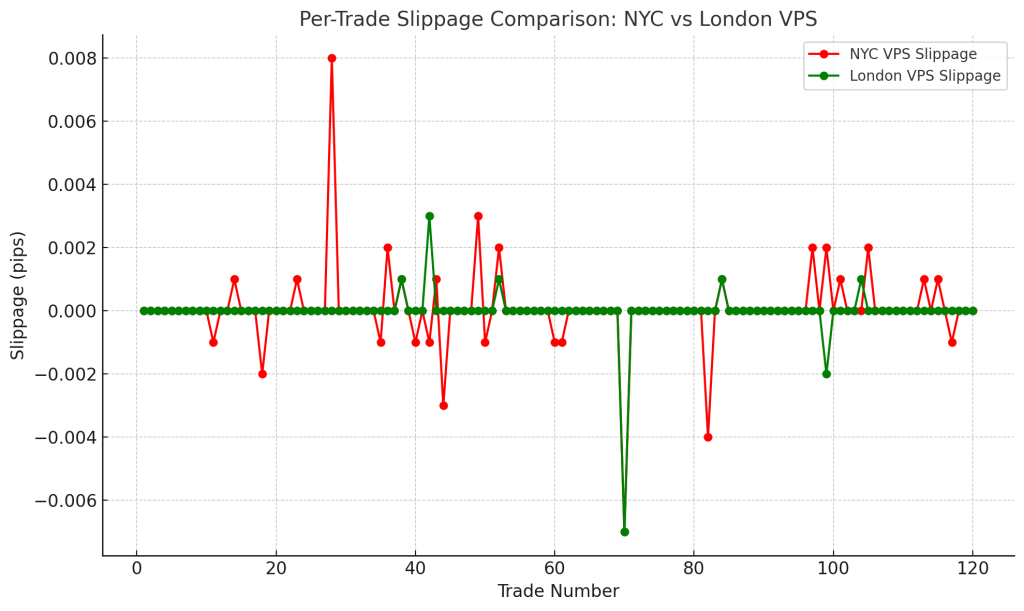

Per-Trade Slippage Analysis: NYC vs London VPS

The chart below illustrates the slippage experienced on a per-trade basis for both VPS setups. Each point represents an individual trade, showing how slippage fluctuated throughout the experiment. Notice how the NYC VPS consistently experienced negative slippage compared to the London VPS, which remained stable. This visual highlights the variability and cumulative impact of slippage caused by higher latency.

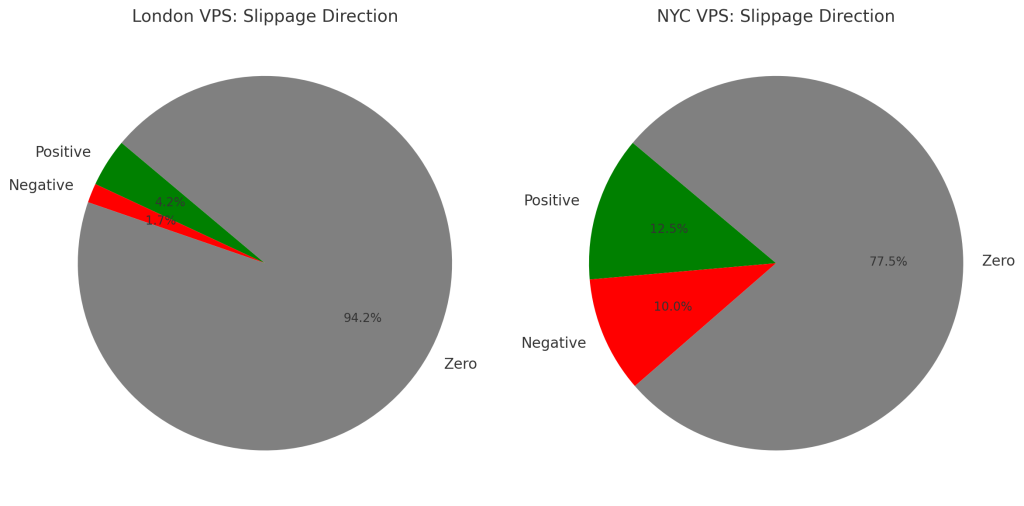

Slippage Direction Comparison: London vs NYC VPS

These pie charts illustrate the proportion of trades with positive, negative, and zero slippage for each VPS setup. The London VPS demonstrates a higher percentage of positive and zero slippage trades, while the NYC VPS shows a significantly greater share of negative slippage, highlighting the impact of latency on trading performance.

Quantifying the Impact on Your Trading:

To put this in perspective, 1.70 pips may not sound like much, but for a trader using 1 lot, 1 pip is equivalent to $10. If you’re trading 100 lots in a month, that’s $1,000 lost—just because of a 1-pip latency. Over a year, that’s $12,000 gone, not because of a bad strategy but because of something completely preventable.

For our experiment, the negative impact is even worse. At a 1.70 pips slippage, the monthly loss would be $1700 and $20,400 yearly. As you can see, over time, it adds up to thousands of dollars lost, all because your trades are not being executed as quickly as they could be.

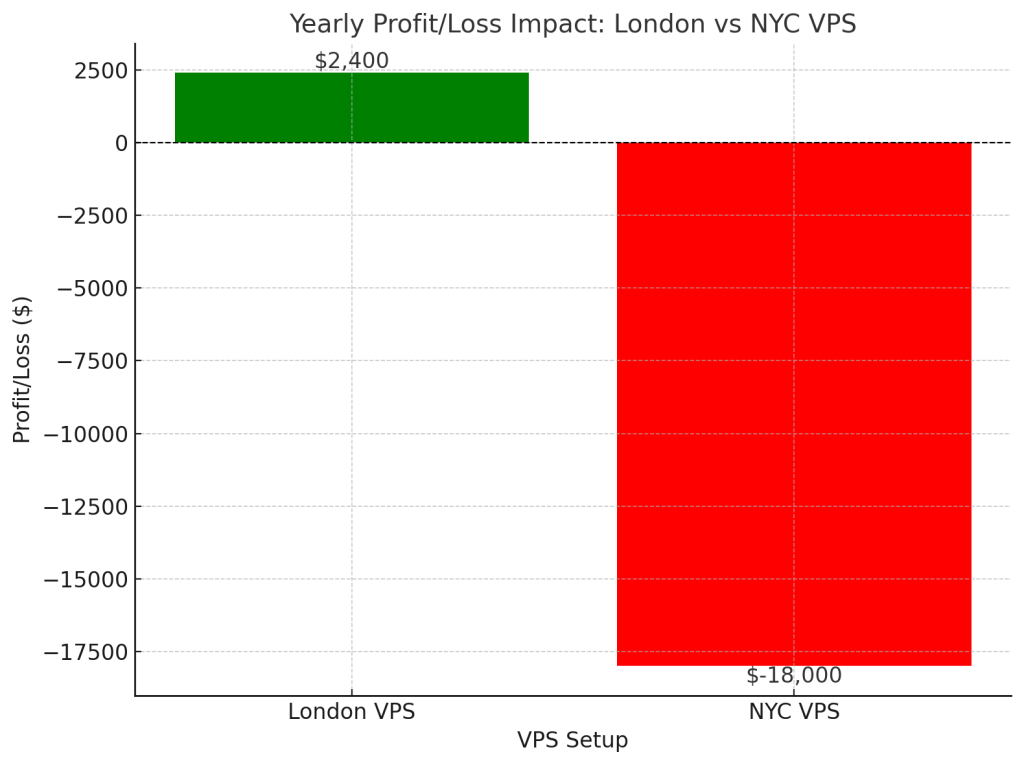

Yearly Profit/Loss Comparison: London vs NYC VPS for 100 traded lots

This chart highlights the yearly monetary impact of slippage for both VPS setups for 100 traded lots. While the London VPS results in a gain of $2,400, the NYC VPS suffers a significant loss of $18,000, underscoring the importance of reducing latency in trading.

The Reality Check: Why Most Traders Underestimate Latency

Latency, in simple terms, is the delay between your trading command and its execution. It’s the difference between when you hit “buy” or “sell” and when that action gets processed by your broker. Even the smallest delay can have a significant impact—resulting in slippage, where the price you wanted isn’t the price you get.

To put it in perspective, think of it as driving a high-speed race car. You see a turn coming up, but by the time you turn the wheel, there’s a delay—and that delay might be the difference between a perfect maneuver or a costly crash. In trading, latency affects your ability to get the best possible price, and when you’re trading large volumes, that can mean thousands of dollars in losses.

The Invisible Hand That Hurts Your Bottom Line

If your broker’s servers are in London and you’re trading from New York, there’s an unavoidable delay. Even if it’s just milliseconds, those milliseconds matter. The closer you are to your broker’s server, the lower your latency, and the better your chances of getting filled at the price you want.

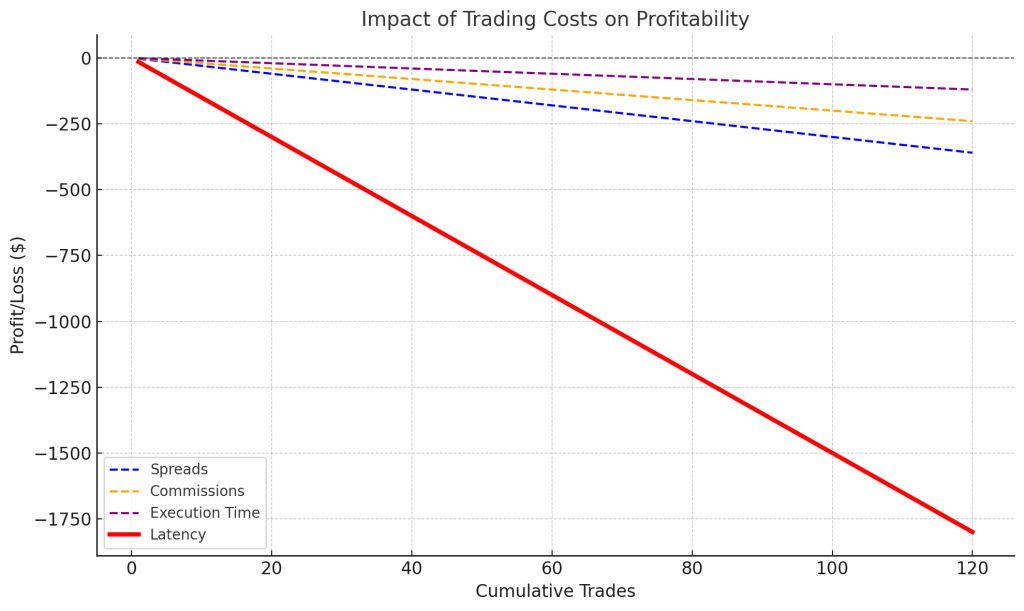

Here’s how latency slippage stacks up against other factors that impact your trading results:

- Spreads: The difference between the bid and ask price.

- Commissions: What your broker charges to execute trades.

- Execution times: How long it takes for your order to be processed.

- Latency: The time it takes for your trade request to reach the broker’s server and for the order to be filled.

While spreads and commissions are fixed costs, latency slippage is the hidden variable that can quietly drain your profits, especially if you’re trading from a server far from your broker.

To illustrate this, the following chart compares the cumulative impact of these trading costs—spreads, commissions, execution time, and latency—on profitability over multiple trades.

While spreads and commissions contribute consistent, moderate losses, and execution time has minimal impact, latency emerges as the most significant factor, causing the steepest decline in profits over time. The stark difference highlights why reducing latency is critical for protecting your trading results and achieving consistent performance.

The Long-Term Impact of Latency on Your Profits

Latency slippage is like a small leak in a boat. At first, it doesn’t seem like a big deal—just a few drops here and there. But over time, that leak grows, and before you know it, your boat is sinking. For traders, consistent slippage compounds over hundreds of trades, and the impact on your profit is undeniable.

If you’re a high-frequency trader or someone who relies on Expert Advisors, minimizing latency is crucial. Even small inefficiencies add up, and they compound with every trade, every day, every month.

Many traders think slippage is just a “market thing”. But in reality, much of it can be avoided by reducing latency. The difference between a profitable EA and one that drains your account can often come down to how quickly your trades are executed.

What About Trading from Home?

Some traders think they can run their EAs from home without any issues. But this is even riskier. Trading from home often means dealing with unreliable internet connections, potential power cuts, and even higher latency. In many cases, latency from a home setup can exceed 100ms, leading to crazy high latency and exposing you to unpredictable slippage.

If you want your EA to run 24/7, your home PC must stay on constantly. This is dangerous and unreliable. Compare that to ForexVPS, where servers are optimized, secure, and always connected—giving you the reliability that home setups simply can’t provide.

The Solution: How ForexVPS.net Eliminates Latency and Saves You Money

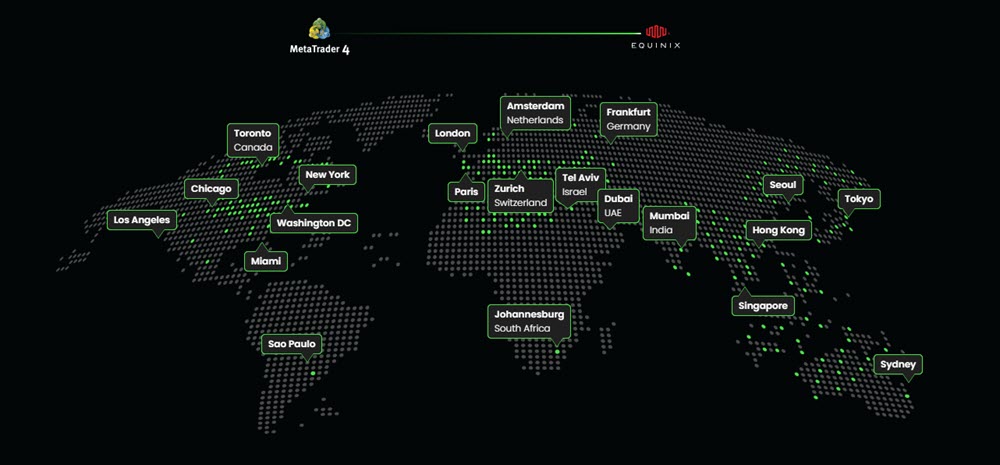

At ForexVPS.net, we co-locate our servers with the major brokers in Equinix Data Centers, the most advanced data centers in the industry. Our VPS servers are designed specifically for traders who need ultra-low latency, often achieving 1-millisecond execution times with brokers.

By choosing ForexVPS, you can:

- Eliminate latency slippage: Reduce the time between trade execution and order fill to almost zero.

- Increase trading accuracy: Get filled at the price you see on your screen, without surprises.

- Save thousands: Prevent unnecessary losses caused by slow execution times.

For anyone running EAs, high-frequency trading, or managing large volumes of trades, having a low-latency VPS is not just an option—it’s a necessity.

Why Location Matters: The Critical Role of VPS Proximity

To keep latency as low as possible, you need to be physically close to your broker’s server. In our experiment, the London VPS performed significantly better only because it was located in the same data center as the broker’s server—Equinix, which is considered the gold standard for trading servers.

This is why choosing the right VPS provider matters. At ForexVPS, our servers are strategically placed in Equinix data centers, right next to major broker servers. We also have over 20 geo locations around the world—including Toronto, Chicago, Los Angeles, Miami, Sao Paolo, Paris, Zurich, Tel Aviv, Frankfurt, Amsterdam, Dubai, Mumbai, Johannesburg, Seoul, Tokyo, Singapore, Hong Kong, and Sydney—ensuring you can get a VPS that’s as close as possible to your broker, providing latency as low as 1 millisecond and minimal slippage.

Also, unlike general VPS providers, we don’t mix and match customers running websites, gaming servers, and e-commerce sites. Our servers are designed and optimized for traders only, meaning you get the reliability and speed you need.

Conclusion: Protect Your Profits and Upgrade Your Trading

In the world of forex trading, time is money. Latency may be a hidden cost, but now that you know it exists, you can take action to protect your trading results.

Don’t let poor execution or slippage eat away at your profits. With ForexVPS.net, you can ensure that your EA performs as it was designed to, without the worry of latency dragging you down.

Ready to transform your trading results?

Take control of your trading future by choosing ForexVPS and join the thousands of traders who are already improving their results with ultra-low latency servers.

Get started now with 47% off and see how reducing latency can transform your trading.

FAQs: Your Questions About Latency and Our Experiment Answered

What is latency in trading, and why does it matter?

Latency in trading refers to the time delay between initiating a trade and having it executed by your broker. This delay can lead to slippage, meaning the price at which your trade is executed might differ from the price you expected. Lower latency means faster execution, which is crucial for getting the best price, especially for high-frequency traders and those using Expert Advisors (EAs).

What is slippage, and how does it relate to latency?

Slippage is the difference between the expected price of a trade and the actual price at which it is executed. High latency increases the chances of slippage because the price can change during the delay. Reducing latency helps minimize slippage, ensuring trades are executed at the intended price.

Why did you choose London and New York City for the experiment?

We chose London and New York City because the broker’s servers were located in London. By comparing a VPS in London (close to the broker) with a VPS in New York City (farther from the broker), we could clearly demonstrate how proximity affects latency and trading results.

How did the experiment work?

We set up two Virtual Private Servers (VPS)—one in London and one in New York City. Both used the same trading strategy on the GBP/JPY currency pair with identical settings. We recorded the price differences between when a trade was initiated and when it was filled to measure the impact of latency on trading performance.

What were the key results of the experiment?

The London VPS, which had an average latency of under 1 millisecond, experienced a cumulative slippage of only +0.20 pips after 120 trades. In contrast, the New York City VPS, with an average latency of about 75 milliseconds, experienced a cumulative slippage of -1.50 pips. This 1.70 pip difference highlights the significant impact of latency on trading results.

How much money can I lose due to latency?

In our experiment, the difference in slippage between the London and NYC VPS was 1.70 pips. For a trader using a 1 lot size, 1 pip is equivalent to $10. Over 120 trades, this difference can add up to $170. If you trade 100 lots a month, a 1 pip difference could cost you $1,000 a month, or $12,000 a year.

How can I reduce latency in my trading?

The best way to reduce latency is to use a VPS that is physically close to your broker’s servers. At ForexVPS.net, we co-locate our servers in major data centers, such as Equinix, close to broker servers to ensure ultra-low latency. This helps minimize slippage and improve your trading results.

What makes ForexVPS different from other VPS providers?

Unlike general VPS providers, ForexVPS specializes in providing low-latency servers specifically optimized for traders. Our servers are strategically placed in data centers near major broker servers, ensuring latency as low as 1 millisecond. We also do not mix trading VPS with other types of services, ensuring maximum performance and reliability for traders.

Who can benefit the most from using a low-latency VPS?

High-frequency traders, traders using Expert Advisors (EAs), and those trading large volumes can benefit the most from using a low-latency VPS. These traders are more sensitive to slippage and execution delays, and reducing latency can significantly improve their profitability.

How can I get started with ForexVPS?

Getting started with ForexVPS is easy. Visit our website, choose the VPS location closest to your broker’s server, and start trading with ultra-low latency. We even offer a discount of up to 47% on new orders so you can experience the difference for yourself.